Credit card fees

Starting April 1, 2023, we apply a 2.9% payment processing fee to invoices paid with credit cards and debit cards in jurisdictions (decided by the billing address in your billing profile) where charging processing fees complies with applicable laws.

In rare circumstances, the processing fee may vary. Currently, the credit card processing fee for invoices paid in Egyptian Pound (EGP) is 4.9%.

Fees calculation

The credit card processing fee is calculated as below:

fee = (invoice_total / (1 - processing_fee_percentage)) - invoice_total

-

The

invoice_totalis the total amount after taxes (Total W/ Tax). -

The fee itself is subject to taxes.

See the following section for an example.

Fees invoices

The credit card fee is applied and collected at the time of payment. You are charged for the sum of invoice and fee, both with taxes if applicable.

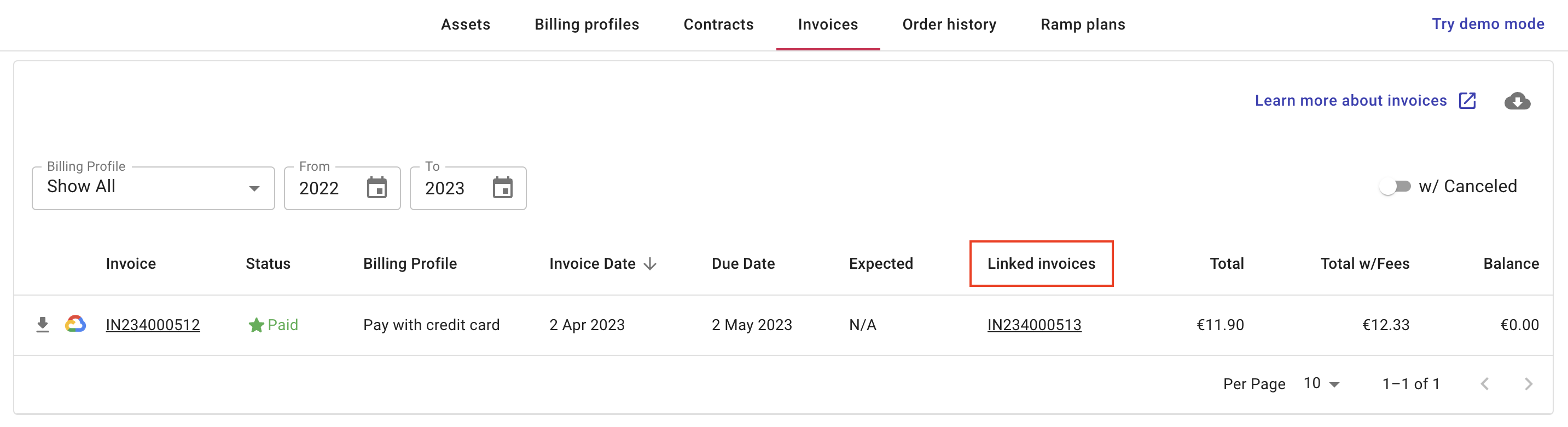

For a successful payment, you'll find a fee invoice in a column called Linked invoices on the main Invoices page.

In the example invoice above:

-

Your original invoice total amount with tax is €

11.90. -

Your final invoice total amount with credit card fees is €

12.33.

To view the details of the credit card fee, select the linked invoice.

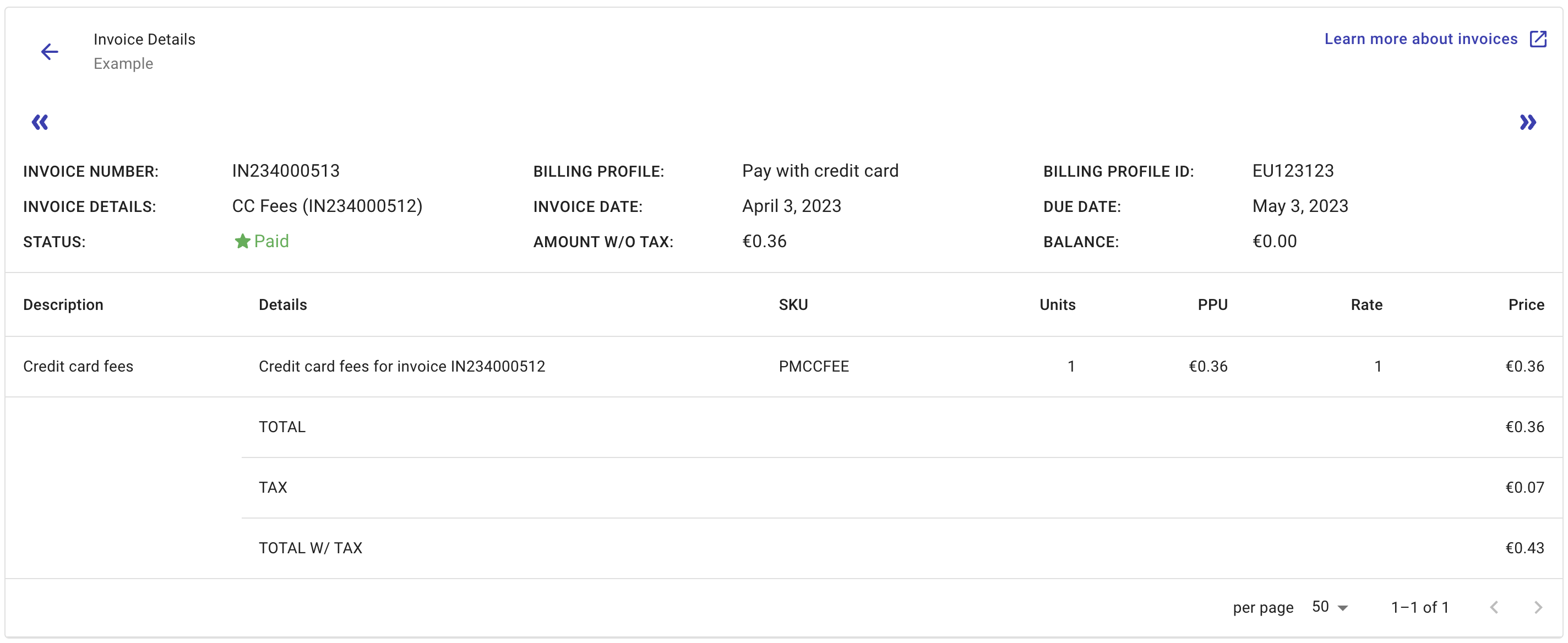

The example fee invoice shows that:

-

Your credit card fee (SKU

PMCCFEE):11.90/(1 - 0.029) - 11.90 = 0.36 -

Your credit card fee with tax:

0.36 + 0.07 = 0.43

Therefore, your final invoice total amount with credit card fees is 11.90 + 0.43 = 12.33.